The Tax Sheltered Annuity (TSA) 403(b) program is a supplemental retirement savings plan available to most employees, including Student Help employees and Rehired Annuitants. Through this program, employees can invest on a pre-tax basis, an after-tax basis (Roth), or a combination of both.

The start of a new calendar year is a popular time for employees to review and update their TSA contributions. The 2020 maximum contribution limit is $19,500 for employees under age 50. Employees 50 or older can contribute (at any time during the plan year) $26,000 ($19,500 + a $6,500 “catch-up”).

Employees already enrolled in the TSA program are able to update their existing contributions online through their MyUW Portal.

How can I update my TSA contributions online?

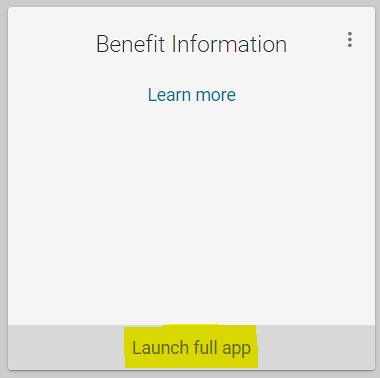

- In the MyUW account, launch the “Benefit Information” widget:

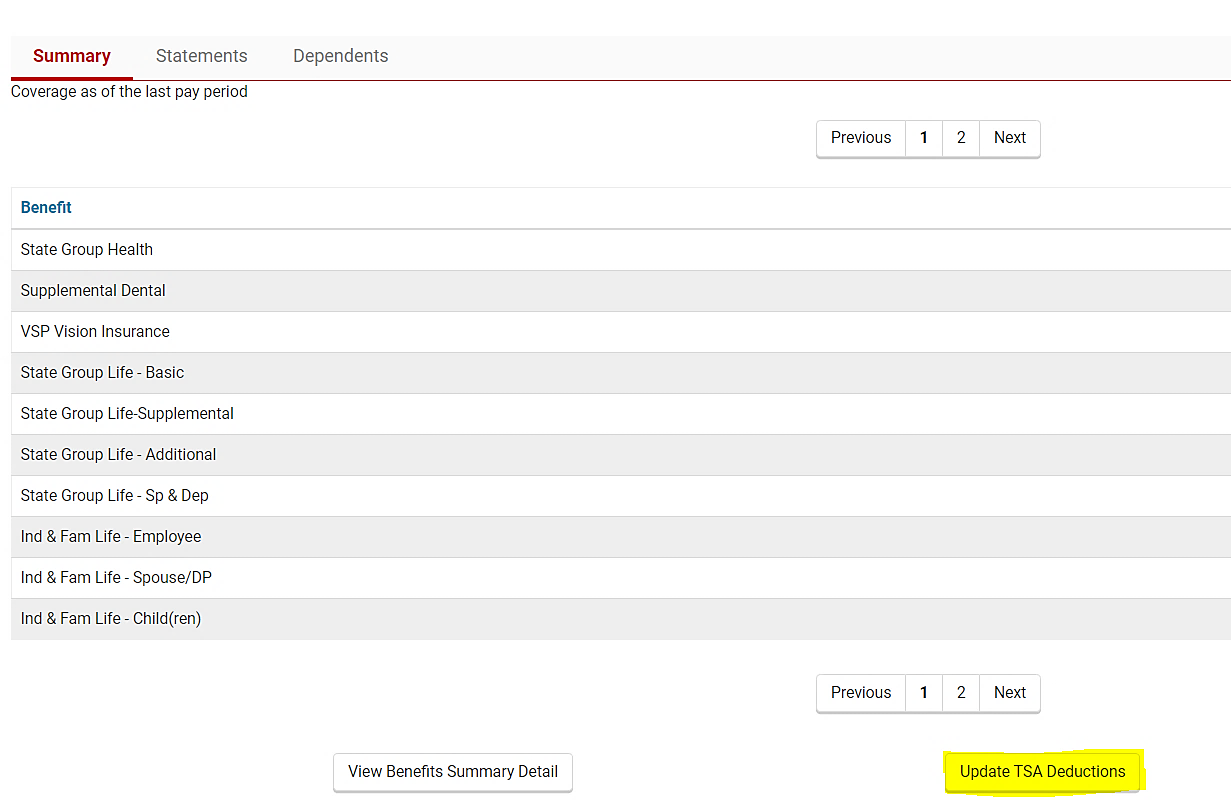

- Next select “Update TSA Deductions” at the bottom of the page. This feature can be used to increase or decrease existing contributions.

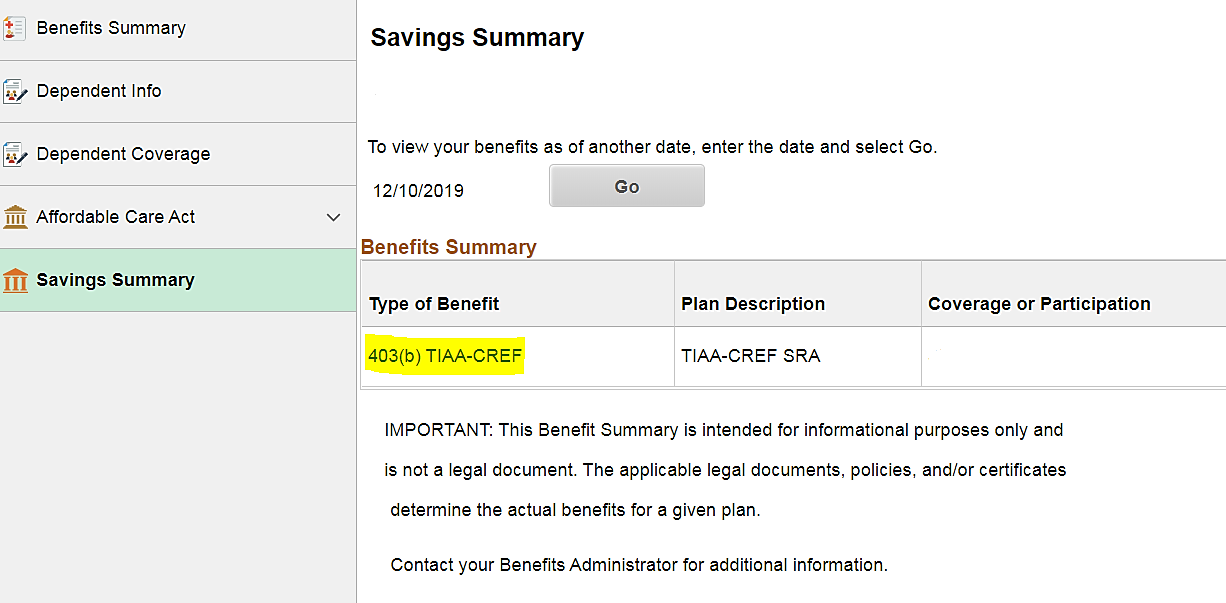

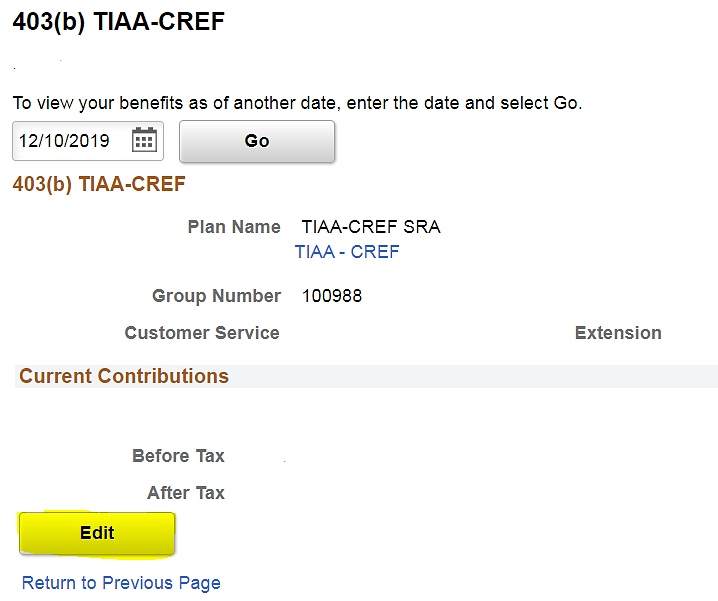

- This will take you to the screen entitled “Savings Summary” where you can select the benefit you’d like to update. In this example, TIAA-CREF is selected:

- Select “Edit” on the next screen.

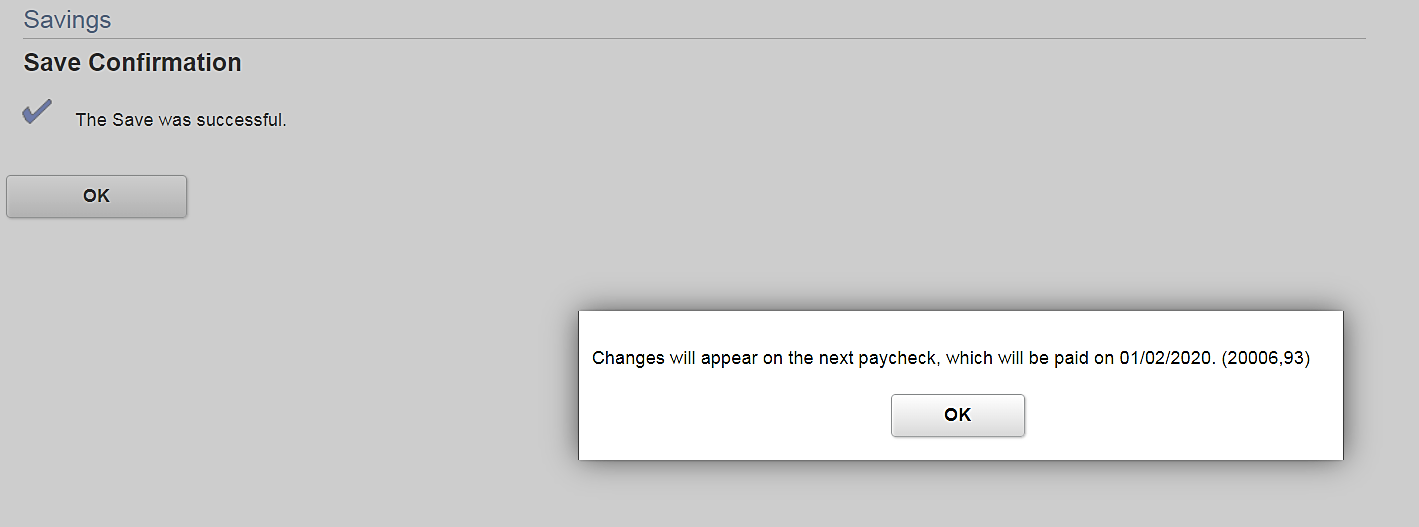

- Enter your new contribution amount (either dollar amount or percentage) and select “Save.” You will receive a confirmation email when the change has been made.